Freedom Leaf Dives Into the Hemp-CBD Market

Freedom Leaf Inc.’s bid to diversify into an industrial hemp cultivator, CBD producer and formulator drew support with a $3 million investment from Merida Capital Partners in October, capping off a busy year of deal-making for the Las Vegas-based company.

While Freedom Leaf (OTCQB: FRLF) has been traded on the Over-The-Counter markets as a fully reporting and audited public company for four years, the transaction with Merida Capital Partners marks the first time it has sold equity in the company to a venture capital firm. Merida Capital is not just any venture firm. It already commands a high profile in the cannabis business as a backer of KushCo Holdings Inc., New Frontier Data, Grow Generation, Emerald Scientific and many others successfully participating in the cannabis and hemp sector.

Freedom Leaf CEO Clifford J. Perry says Merida Capital’s long-term view on its investments reflects the firm’s name, taken from an area in Spain where the Romans built aqueducts that have stood for some 2,000 years: “They stay with their companies and promote acquisitions and synergy in their portfolio. So far, they’ve been tremendously successful.”

Perry likes to call Freedom Leaf the “little train that could” since it started out as a publisher of a magazine and is now branching out into hemp cultivation and full-spectrum CBD extraction businesses in a flurry of transactions.

FREEDOM LEAF’S CLIFF PERRY: “In two to three years, the market will consolidate. By then, we’ll have market penetration.”

In one of its more high-profile deals, in June, Freedom Leaf acquired a 430,000-square-foot greenhouse nursery for cultivation and production of legal industrial hemp in Valencia, Spain, including light deprivation throughout the greenhouse and a 43,000-square-foot indoor growing research facility, which Freedom Leaf operates under the name Leafceuticals Europe, S.L.U. Among its other transactions, in August, Freedom Leaf agreed to pay $2.2 million for Tierra Science Global, a health supplements firm that generated more than $500,000 in revenue in the first six months of 2018.

As part of the deal, Freedom Leaf plans to manufacture a number of hemp full-spectrum CBD oil products, including two skin serums created by Beverly Hills anti-aging practitioner Dr. Naina Sachdev. Freedom Leaf hired biomedical engineer Purdue graduate, Nicholas Shi to optimize the extraction and distillation processes of Leafceuticals Inc. Shi is focusing on improving hemp CBD oil yields, fractional distillation of other rare cannabinoids, terpenoid processing time and product quality at the Leafceuticals Inc. extraction lab in North Las Vegas.

Freedom Leaf also, in March, purchased Irie CBD, a CBD product company that generated $1.5 million in revenue in 2017, and is manufacturing products under the Hempology brand as well.

Merida Capital and its affiliates acquired $3 million worth of Freedom Leaf stock through a private investment in a public entity for a significant minority stake in the company. Merida Senior Partner David Goldburg will be joining Freedom Leaf’s board of directors as part of the deal.

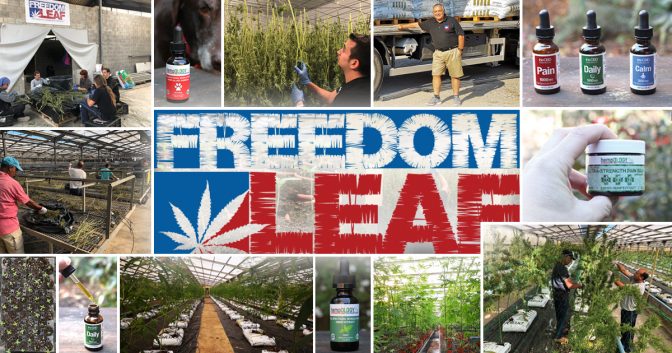

That’s hemp growing at Freedom Leaf’s Leafceuticals Europe, S.L.U. property in Valencia, Spain.

Mitch Baruchowitz, managing partner at Merida Capital, says the firm was drawn to the Freedom Leaf’s acquisitions in the CBD space, among its other properties: “It seemed like they’d rolled up some interesting CBD products and brands which could be expanded quickly, including a stable consumer CBD business, Irie. Plus, they’ve made some inroads in Europe where we’re interested in making investments. We invest in companies that are growing fast. Freedom Leaf has done a good job of finding assets in a frugal and responsible manner.

“Merida’s investment is a validation of Freedom Leaf’s aggressive efforts to build a high-quality family of cannabidiol-based products, but it’s also an acknowledgement of the potential for the Valencia, Spain cultivation facility to become a significant supplier of both hemp and cannabis to European markets in the immediate future.”

Merida invested in Freedom Leaf Inc. from Merida Capital Partners LP II, which has deployed $40 million thus far since February.

To be sure, the acquisitions and a focus shift from license sales to product sales have weighed on Freedom Leaf’s bottom line. For the 12 months ended June 30, the company reported a net loss of $4.6 million, compared to a loss of $910,000 in the prior 12 months when revenue fell to $411,272 from $817,457. The company cited a decrease of license sales offset by increases in product sales. Management has indicated that its increased expenses to support its acquisitions and additional product sales already is bearing fruit in terms of increasing revenues.

But the CBD opportunity remains huge, with interest from a wide variety of industries and the expected passage of the 2018 Farm Bill, which will reclassify hemp as an agricultural commodity regulated by the U.S. Department of Agriculture.

MERIDA CAPITAL’S MITCH BARUCHOWITZ: “Freedom Leaf has done a good job of finding assets in a frugal and responsible manner.”

Industrywide sales in the global industrial hemp and CBD market will total about $3.9 billion, with a compounded annual growth rate of 14% by 2025, according to estimates from Grandview Research. In the U.S., Frontier Data forecasts CBD sales will hit $1.2 billion in 2020 and $2 billion by 2022. The market for CBD, an ingredient for food, beverages, beauty and medicine, is projected to grow at a rate of 39% through 2021, according to estimates from market re-search firm Technavio.

Perry sees Freedom Leaf as a potential beneficiary from mergers and an acquisition in the CBD space with winners emerging as the industry grows. “In two to three years, the market will consolidate,” he predicts. “By then, we’ll have significant market penetration.”

Freedom Leaf continues to seek whole-sale buyers for its CBD products as it works on setting up its infrastructure and production in Spain and Nevada with backing from Merida Capital.

Perry has met with many executives and entrepreneurs that are formulators and suppliers of nutritional products to health food, big box stores and others. These companies are setting up labs around the country for CBD extraction, part of an expected wave of production. Pharmaceutical companies will also be on the hunt for Active Pharmaceutical Ingredients (APIs). Perry said the company is in talks to potentially supply them with APIs from its European hemp facilities.

With Freedom Leaf’s roots in cannabis/hemp activism, the company is now positioned as a major player in the hemp and CBD markets. “We didn’t get into this yesterday,” Perry explains. “The secret sauce of Freedom Leaf is that we’ve become a fully vertically integrated hemp CBD company. We’re doing genetic research to develop high-CBD, low-THC strains of cannabis. We also do formulation and processing and have retail brands selling CBD products to consumers. We’re a brand you can trust.”

Related Articles

Hemp to the Future: U.S. and Canada Industrial Crops on the Rise

The Epidiolex Effect: Will Other CBD Drugs Receive FDA and DEA Approvals?

PrAna Takes Lead in Hemp-Clothing Revival

Hemp’s Long Road to Respectability

This article appears in Issue 34. Subscribe to the magazine here.